Apple's (AAPL) maverick image and marketing made it a hit with consumers and investors when smartphones were novel. But as boring replaces bold at the giant - investors need to reset their expectations, analysts say.

Fast-growth is being replaced with "annuity-like revenue streams" as Apple is "now mainstream and not the upstart," says UBS analyst Steven Milunovich in a note to clients Thursday. "Some might be disappointed that Apple isn't reinventing the world," he says. Milunovich expects 5% growth in iPhone unit sales in the current fiscal year. That's still a whopping number of smartphones being sold - 49 million in the current quarter - but on Wall Street single-digit growth just doesn't impress.

Investors and analysts are adjusting what they can expect from Apple - given the company is a behemoth and mathematically unlikely to put up the kind of growth that turned the stock into such a champ in the past. The same fate has met other high-growth companies that have matured as their products reached saturation and improvements have become incremental.

Meanwhile, Apple faces the additional challenge that carriers are moving away from subsidies, leaving consumers to see - often for the first time - what they're actually paying for upgraded phones. Sticker stock could cause some consumers to keep their existing "good enough" phones longer than two years.

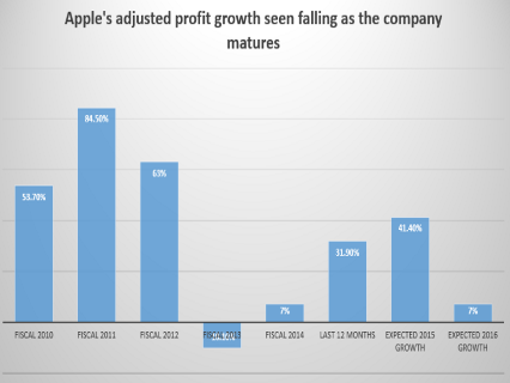

And the iPhone 6S isn't a compelling upgrade - which changes the math at Apple. Even the iPhone 6 - which was seen as a big upgrade as the company finally matched the larger screen sizes of phones from Samsung and Microsoft (MSFT) - Apple's adjusted earnings grew 39%. That's a stellar growth rate - but still a fraction of the 54% adjusted profit growth in 2010 and 85% growth in 2011.

Reality is sinking in fast along with maturation. Analysts expect adjusted earnings growth to grow 32% in the current quarter - but then - drop off fast as the iPhone 6S fails to inspire the same level of upgrade fever. Adjusted profit growth is expected to be just 3.6% in the fourth calendar quarter and hit just 5.2% in the first quarter. Adjust profit growth is seen as being just 7% in fiscal 2016.

Meanwhile, the company has been widely called out on the fact it's newest product, the iPad Pro, is "aping Microsoft's Surface," Milunovich wrote. Microsoft released a tablet with a keyboard and stylus more than three years ago.

What's this mean for Apple stock? Most analysts remain bullish and think the stock could be worth close to $150 a share in 18 months. That would be 33% upside if correct. Shares of Apple closed up $2.42, or 2.2%, Thursday to $112.57. "Incrementalism not all bad," as the company can work on becoming more predictable and focus on selling more things to its loyal customers, Milunovich says .

But many investors may only be starting to appreciate how a maturing product can put a stock in neutral. Shares of Apple are down roughly 16% from the highs notched this year as investors confidence was soaring. "We remain cautious on Apple for the rest of the yer as we think the company has tough compares for iPhones, which could make it tough for the stock to work," says Abhey Lamba, analyst with Mizuho , who has a $125 price target on the stock.